[ad_1]

Megacap progress and tech stocks have run strong gains on Wall Avenue this 12 months, with massive tech shares getting risk-free-haven standing for traders fearing a potential recession and volatility in the banking sector. The rally even now has far more space to run, in accordance to strategists at Deutsche Financial institution.

See: Are tech stocks turning into a haven all over again? ‘It’s a oversight,’ say industry analysts.

The tech-focused Nasdaq-100 index

NDX,

which tracks the major 100 nonfinancial companies stated on the Nasdaq Exchange which includes Apple Inc.

AAPL,

Meta Platforms Inc.

META,

Tesla Inc.

TSLA,

and NVIDIA Corp.

NVDA,

previous week ended the thirty day period at its optimum level considering that August, and state-of-the-art far more than 18% for the quarter, according to Dow Jones Current market Info. That compares with a 7% quarterly achieve for the broader S&P 500 index

SPX,

and a basically .4% boost for the Dow Jones Industrial Typical

DJIA,

Tech-relevant shares have rebounded right after a brutal 2023 that noticed them bear the brunt of a wide industry selloff.

“So considerably, the rally has mainly mirrored an unwinding of underweight positioning,” wrote strategists led by Binky Chadha, Deutsche Bank’s main U.S. equity and world strategist. “We see the subsequent leg being driven by earnings beats and growing forward estimates on which there has been incredibly little concentrate so far.”

Chadha and his team stated a pickup in international advancement in the close to-term and a peak in the U.S. dollar stage to a sizable rebound in earnings advancement for megacap development and tech stocks.

“The top rated-down drivers of all round earnings as properly as those for megacap growth and tech shares have been upgraded substantially in latest weeks, with our economists boosting their in the vicinity of-phrase forecasts for GDP expansion in the U.S., Europe, China and Japan for a variety of distinctive reasons, when the greenback has fallen drastically.”

The ICE U.S. Dollar Index

DXY,

a evaluate of the forex versus a basket of 6 main rivals, has dropped 1.5% year-to-date as of Wednesday.

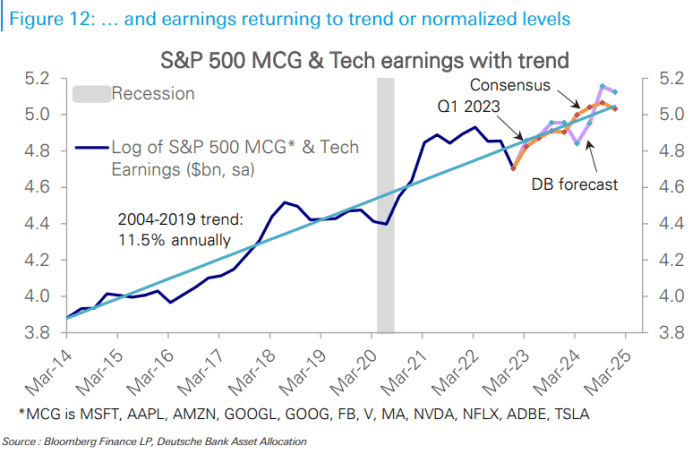

Deutsche Bank’s forecasts see tech earnings rebounding off the bottom of the development channel, returning to pattern amounts in Q1 and then rising in line via the rest of 2023 and 2024. (See chart underneath)

Supply: BLOOMBERG FINANCE LP, DEUTSCHE Lender ASSET ALLOCATION

Tech shares outperformed massively in the initially fifty percent of 2020 in the pandemic boom when the Federal Reserve slashed desire prices and pumped trillions of bucks into economies. Stocks then went sideways for the future 18 months, right before underperforming in 2022 when the central lender started its intense fascination-level hikes to control the inflation.

See: What tech bust? Big Tech shares acquired $2 trillion in roaring begin to 2023

Consensus estimates for tech earnings in the first quarter of 2023 have risen 1% due to the fact early February, the first enhance in a calendar year, and in contrast with continued downgrades to all the other important indexes, said Chadha.

In the meantime, the upgrades also came notably after the bulk of the previous earnings season was over. That’s abnormal, as estimates are typically flat to down in between earnings seasons, he wrote.

“In the last three earnings seasons, analysts noticed up coming-quarter estimates slide concerning 1.5% and 3% at this phase. Even following the updates, our estimates recommend a 3.5% conquer for megacap development and tech stocks in Q1. This would be the greatest since Q4 2021 and stick to 4 quarters of weak beats or outright misses which occurred in spite of estimates being slash likely into reporting,” they wrote.

If the Deutsche Financial institution forecasts are proper, that could suggest that forward estimates of subsequent 12 months earnings, which had fallen by way of 2022, ought to inflect up and continue to keep rolling larger for the relaxation of 2023, mentioned Chadha.

U.S. stocks concluded mostly decreased on Wednesday as traders weighed info on personal-sector employment and the solutions sector. The Nasdaq Composite

COMP,

slumped 1.1%, whilst the S&P 500 missing .3% and the Dow industrials received .2%.

[ad_2]

Resource hyperlink