[ad_1]

Client expending has defied Wall Street anticipations all yr, both by preserving shares afloat near history levels and by preventing the U.S. economic system from functioning aground into a economic downturn.

Which is why sentiment close to stocks in the week forward could hinge on two similar economic data points: the consumer-price index (CPI) for August thanks on Wednesday and month-to-month U.S. retail gross sales slated for a working day afterwards.

“They are hanging in a good deal for a longer time than we all gave them credit score for final yr,” stated Jason Blackwell, chief expenditure strategist at The Colony Group, of the willingness of people to devote, in spite of credit rating-card desire premiums eclipsing 20% and inflation however previously mentioned the Fed’s 2% annual target amount.

“Our watch is that the purchaser does continue being relatively healthy and is able to hold up with costs maximize,” he reported.

The annually CPI bumped up to 3.2% last month, but has declined from a peak of 9.1% past calendar year. Blackwell will be watching Wednesday’s financial update for indications of easing in shelter, a “sticky” type of inflation, which in July was pegged at 7.7% annually, even nevertheless residence prices in the past year have fallen. “There’s a disconnect that wants to slender, at some place,” he reported.

The sharp increase in mortgage loan rates has been fewer harming to the housing sector than it could have been in an earlier era. That is due to the fact most house owners presently refinanced at traditionally low pandemic fees, furnishing a buffer as the Fed elevated its coverage fee to a 22-year higher.

A decade of underbuilding also has saved charges from tumbling, even as income dropped, leaving many individuals with a huge equity cushion in their households. At the identical time, wages have been increasing and the financial state has refused to capitulate.

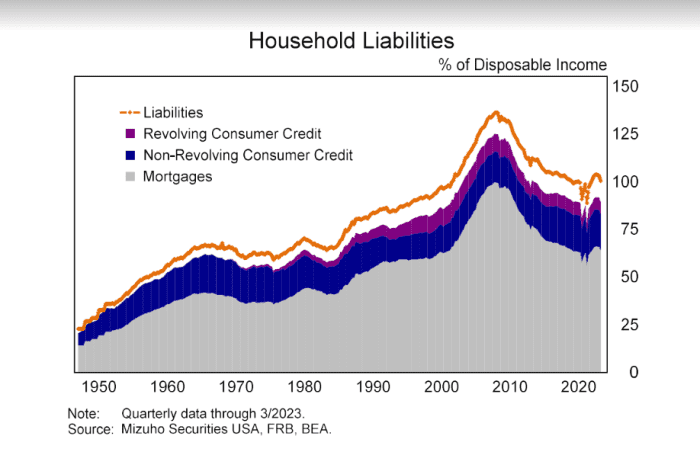

Putting it all together indicates a recipe for ongoing spending, notably with house credit card debt-to-incomes nevertheless in the vicinity of a 20-12 months lower of about 100%, in accordance to Mizuho Securities.

Home personal debt-to-income sits in the vicinity of a 20-12 months minimal, translating to resilience in client investing.

Mizuho Securities, Federal Reserve Board, Bureau of Economic Analysis

“The marketplace has been expecting a recession for the past yr or so, and has been erroneous,” reported Michael Rosen, main financial commitment officer at Angeles Investments. “In some sense, they most likely are even now seeking for a economic downturn. I assume that’s also completely wrong.”

That is because Rosen sights today’s greater desire costs as significantly less ominous than other folks may well assume, specially with wage gains and robust households stability sheets able to continue to keep the economic system buzzing, even if spending largely has exhausted pandemic discounts.

“There has been some weakness in the producing sector, but it’s the customer that dominates our economic climate,” Rosen claimed. That has been reflected in modern economic knowledge but also in jammed airports, dining places or at a person of Beyoncé or Taylor Swift’s sold out summer concert events, he said.

In July, sales at U.S. suppliers mirrored the most significant raise in 6 months. Greater power prices could participate in a position in looming financial facts for August. But Rosen however sights the backdrop for stocks and quick-time period Treasury securities as favorable.

“The sector climbs a wall of fear and which is exactly what’s been going on right here,” he claimed, including that he expects stocks to shift greater. “What drives marketplaces is profits and corporate revenue are sturdy.”

John Butters, FactSet’s senior earnings analyst on Friday mentioned he’s forecasting a web revenue margin for the S&P 500 index of 11.7% for the 3rd quarter, which would be earlier mentioned the 11.6% figure for the earlier quarter and above the 11.4% 5-12 months ordinary.

“Investors are likely to have quick reminiscences,” Rosen mentioned, pointing to a Fed money costs that hit double-digits in the 1980s. but being significant as the economic system expanded for most of the decade. “Five per cent is a pretty standard fascination amount,” he mentioned. “I’d even go more and say zero desire prices are hazardous for the economy.”

U.S. shares shut the 7 days decrease, with the S&P 500 index

SPX

down 1.3% for the week, the Dow Jones Industrial Common

DJIA

.8% reduce and the Nasdaq Composite Index

COMP

shedding 1.9% for the 7 days, in accordance to Dow Jones Industry Data.

Bigger image, the Dow finished Friday only 6% absent its file superior established in January 2022, while the S&P 500 was 7% beneath its prior peak. Yields on 3-thirty day period

BX:TMUBMUSD03M

and 6-month

BX:TMUBMUSD06M

Treasurys have been over 5% considering that this spring.

[ad_2]

Resource connection