[ad_1]

U.S. stocks continue being in a potent bull market place inspite of modern choppiness, as the correlations amongst 11 S&P 500 sectors and the significant index are sending some favourable indications, in accordance to DataTrek Analysis.

The S&P 500’s sector correlations to the big-cap index have been underneath the ordinary due to the fact mid-April, which implies traders are more focused on fundamentals than macroeconomic forces as they consider to outperform by buying what they hope will be successful sectors and stocks in a bull sector, claimed Nicholas Colas, co-founder of DataTrek Study.

“… by this evaluate U.S. significant caps keep on being in fantastic condition,” wrote Colas in a Tuesday take note. “Investors are even now concentrated on fundamentals relatively than macro challenges, which is the way it really should be. Of course, stocks got ahead of them selves at the conclude of July and probable however will need some time before they flip greater yet again, but the correlation facts says we stay in a for a longer time-time period bull industry.”

Colas said ordinarily in bull markets, investors hope to beat the broader stock current market by picking out top rated gainers and sectors, so corporate and marketplace fundamentals make a difference a lot more than macroeconomic things these as desire charges, economic downturn dangers and geopolitical worries.

As a end result, the correlation between the S&P 500 sectors and the index would be lessen than normal due to the fact bull markets have both winners and losers, so the index moves up bit by bit, Colas explained.

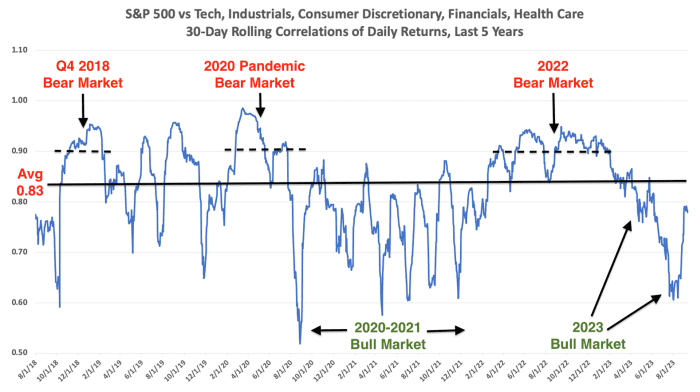

The following chart captures these dynamics. In excess of the very last five many years, the ordinary correlation of the five most significant sectors in the S&P 500 to the index as a complete has been .83, in accordance to facts compiled by DataTrek.

A correlation worth near to zero indicates a weak romance concerning the two variables becoming compared, whilst a worth near to 1 means a strong correlation involving them.

Source: DATATREK Study

Colas explained if correlations run persistently underneath .83, a bull marketplace is underway, but if they reach and hold at .9 for a lot more than a several months, that usually means shares are in a bear sector.

“By this evaluate, we are in a bull current market correct now. Correlations have been under common considering the fact that mid-April 2023 and continue to be so even now,” said Colas.

The S&P 500

SPX

formally exited its longest bear-sector run considering the fact that 1948 and entered the bull marketplace in early June. The S&P 500 Purchaser Discretionary Sector

XX:SP500.25

and the Interaction Services Sector

XX:SP500.50

have highly developed 34.8% and 43.4% 12 months to day, respectively, in comparison with the S&P 500’s 16.2% obtain so considerably this year, in accordance to FactSet knowledge. The S&P 500 Consumer Staples Sector

XX:SP500.30

was off 3.2%, while the Utilities Sector

XX:SP500.55

has dropped 10.6% in excess of the similar interval.

See: U.S. stocks are experiencing a triple risk that could lead to a lot more losses forward

What has took place this 12 months is a welcome improve for the stock industry, but it is a mirror graphic of 2022 as bear marketplaces present quite couple of strong performers, so every thing unravels at the exact time, Colas said.

In a market downturn, traders would consider to preserve cash by selling “essentially everything” to avoid even further losses when macroeconomic ailments trump fundamentals of businesses, he claimed.

Very last calendar year, each and every S&P 500 sector misplaced income on a overall return foundation apart from for Electrical power

XX:SP500.10

and Utilities sectors as runaway inflation compelled the Federal Reserve to hike desire charges 7 occasions a year in a campaign to get prices below handle. The S&P 500 slumped 19.4% to suffer its worst 12 months considering the fact that the 2008 economical crisis.

U.S. shares ended decrease on Tuesday as investors seemed ahead to the greatly anticipated studying on August inflation from the client-rate index on Wednesday early morning. The S&P 500 misplaced .6% and the Nasdaq Composite

COMP

was off 1%, while the Dow Jones Industrial Normal

DJIA

dropped a lot less than .1%.

MarketWatch stay coverage: Apple Occasion: New Apple iphone 15, Apple Observe introduced

[ad_2]

Source url