[ad_1]

Here’s a believed for buyers: If the Federal Reserve raises desire rates to 5% or more would that wreck the financial system and inventory costs ?

The U.S. inventory current market has been rallying to start out 2023, clawing again a significant chunk of the distressing losses from a 12 months in the past. The bullish tone has been connected to a check out that the Federal Reserve will want to slice interest rates this year to prevent a recession, reversing one of its quickest charge-raising campaigns in record.

Doomsday investors, together with hedge-fund billionaire Paul Singer, have been warning against that final result. Singer thinks a credit score crunch and deep recession may be essential to purge risky concentrations of froth in markets after an period of near-zero interest premiums.

A further scenario may well be that very little adjustments: Credit rating markets could tolerate fascination fees that prevailed ahead of 2008. The Fed’s plan charge could boost a little bit from its present 4.75%-5% array, and continue to be there for a whilst.

“A 5% desire fee is not heading to split the marketplace,” mentioned Ben Snider, controlling director, and U.S. portfolio strategist at Goldman Sachs Asset Administration, in a cellphone interview with MarketWatch.

Snider pointed to several hugely rated businesses which, like the bulk of U.S. home owners, refinanced old credit card debt in the course of the pandemic, chopping their borrowing expenditures to in close proximity to history lows. “They are continuing to take pleasure in the reduced charge ecosystem,” he reported.

“Our see is, certainly, the Fed can keep charges here,” Snider reported. “The financial system can continue on to expand.”

Revenue margins in focus

The Fed and other world-wide central financial institutions have been dramatically increasing desire prices in the aftermath of the pandemic to fight inflation triggered by offer chain disruptions, worker shortages and government shelling out guidelines.

Fed Governor Christopher Waller on Friday warned that interest prices may possibly have to have to maximize even a lot more than marketplaces presently anticipate to restrain the increase in the charge of dwelling, mirrored lately in the March purchaser-value index at a 5% annually fee, down to the central bank’s 2% once-a-year focus on.

The sudden rise in desire charges led to bruising losses in stock and bond portfolios in 2022. Greater rates also performed a function in very last month’s collapse of Silicon Valley Lender following it bought “safe,” but charge-delicate securities at a steep decline. That sparked considerations about threats in the U.S. banking method and fears of a probable credit rating crunch.

“Rates are undoubtedly higher than they ended up a 12 months ago, and increased than the past ten years,” stated David Del Vecchio, co-head of PGIM Fixed Income’s U.S. financial investment quality corporate bond group. “But if you look above more time durations of time, they are not that substantial.”

When investors invest in company bonds they are likely to target on what could go wrong to avoid a comprehensive return of their expense, moreover interest. To that stop, Del Vecchio’s crew sees corporate borrowing prices keeping higher for extended, inflation remaining earlier mentioned concentrate on, but also hopeful indicators that numerous remarkably rated corporations would be starting off off from a strong position if a recession however unfolds in the around foreseeable future.

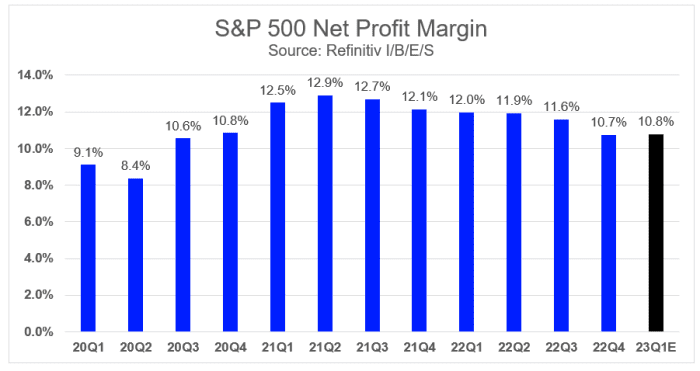

“Profit margins have been coming down (see chart), but they are coming off peak degrees,” Del Vecchio said. “So they are continue to pretty, pretty powerful and trending reduce. In all probability that carries on to development reduce this quarter.”

Internet revenue margins for the S&P 500 are coming down, but off peak stages

Refinitiv, I/B/E/S

Rolling with it, such as at banks

It is not tricky to appear up with causes why stocks could however tank in 2023, agonizing layoffs may emerge, or trouble with a wall of maturing business serious estate credit card debt could toss the financial system into a tailspin.

Snider’s group at Goldman Sachs Asset Management expects the S&P 500 index

SPX,

to conclude the calendar year all over 4,000, or roughly flat to it is closing degree on Friday of 4,137. “I wouldn’t get in touch with it bullish,” he reported. “But it isn’t practically as terrible as many traders expect.”

“Some extremely levered firms that have debt maturities in the in the vicinity of long run will wrestle and may perhaps even wrestle to preserve the lights on,” reported Austin Graff, main investment decision officer at Opal Cash.

However, the financial state isn’t probably to “enter a economic downturn with a bang,” he explained. “It will most likely be a gradual slide into a recession as corporations tighten their belts and lessen paying, which will have a ripple result throughout the economy.”

Nonetheless, Graff also sees the advantage of higher fees at major banks that have improved managed desire charge challenges in their securities holdings. “Banks can be quite worthwhile in the recent rate atmosphere,” he reported, pointing to substantial banking companies that generally present .25%-1% on buyer deposits, but now can lend out money at rates all around 4%-5% and better.

“The distribute the banking institutions are earning in the existing desire price sector is staggering,” he reported, highlighting JP Morgan Chase & Co.

JPM,

providing guidance that included an believed $81 billion net interest income for this calendar year, up about $7 billion from last yr.

Del Vecchio at PGIM reported his group is even now anticipating a relatively shorter and shallow economic downturn, if 1 unfolds at all. “You can have a condition where it’s not a synchronized economic downturn,” he mentioned, adding that a downturn can “roll through” diverse elements of the financial state instead of just about everywhere at the moment.

The U.S. housing current market noticed a sharp slowdown in the previous calendar year as house loan charges jumped, but currently has been flashing favourable signs though “travel, lodging and leisure all are even now executing effectively,” he reported.

U.S. shares closed decreased Friday, but booked a string of weekly gains. The S&P 500 index attained .8% over the past 5 times, the Dow Jones Industrial Regular

DJIA,

superior 1.2% and the Nasdaq Composite Index

COMP,

shut up .3% for the 7 days, in accordance to FactSet.

Traders will listen to from extra Fed speakers upcoming 7 days ahead of the central bank’s upcoming plan conference in early May possibly. U.S. financial knowledge releases will involve housing-related info on Monday, Tuesday and Thursday, when the Fed’s Beige Guide is owing Wednesday.

[ad_2]

Resource backlink