[ad_1]

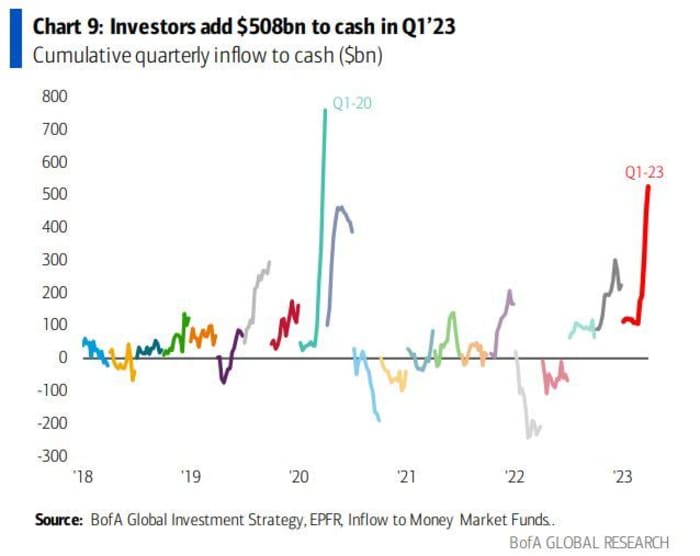

Inflation and economic downturn problems, adopted by a banking disaster, drove billions of trader funds into hard cash in the initially quarter of 2023 — the most considering the fact that the pandemic’s outbreak.

Which is according to the hottest “Flow Show” survey from Bank of The us released Friday that claimed $508 billion flowing into the perceived safer haven of dollars in the first three months of the year. That marked the most significant quarterly inflow because the 1st quarter of 2020, as investors reeled from the world wide outbreak of a fatal pandemic. Income generally refers to Treasury expenditures with a period of six months or fewer.

Uncredited

The bank’s analysts explained around the week to March 29, that some $60.1 billion was converted to money, and a lot more than $100 billion in excess of the past two weeks. For the week, $2.3 billion went to bonds and $500 million to gold, whilst $5.2 billion was yanked from equities.

Current information from Crane showed that assets held by dollars-market cash that commit in limited-maturity personal debt securities with very low credit score threat past week soared to a record substantial of $5.4 billion.

The quarter is set to conclude with a roughly 5.5% gain for the S&P 500

SPX,

just after a 19% drop previous yr, but a 14% surge for the Nasdaq Composite

COMP,

rebounding from a 33% slump in 2022.

“Conventional wisdom in Jan. was China reopening so extended vitality, commodities & EM, a Fed pivot was imminent so consensus was long produce curve steepeners, and keep away from shares as Q1 would see EPS recession,” reported a crew led by Michael Hartnett, Financial institution of America’s chief expenditure strategist. A steepener helps make revenue when the bond yield differential boosts or widens out.

Here’s what BofA’s had to say about their “conventional wisdom” prediction for the 2nd quarter: “Fed chopping 160 basis details immediately after May, so extensive Huge Tech economic downturn a slam dunk, so small compact caps and banks (…and market commodities as China troughing not surging), and very long gold as U.S. greenback in bear current market pain trade is economic downturn once once more delayed by stimulus, labor market does not crack, inflation stays significant, sector reprices reduce but cyclicals outperform.”

The fallout from the disaster that collapsed a few U.S. banking institutions and just one abroad loan company, has ongoing to dent on trader hunger for financials, even amid hopes it could be abating, with $600 million in outflows in the most recent 7 days, the most in 10 months. Know-how shares, in the meantime, are obtaining some secure-haven bids and driving hopes that the Federal Reserve will be accomplished with fascination level hikes soon, and so saw a sixth straight 7 days of inflows, the longest these kinds of streak given that April 2022.

Read: Are tech stocks turning into a haven once again? ‘It’s a oversight,’ say market place analysts.

Purchaser-themed equities saw the most important inflow in eleven weeks of $700 million. Financial investment-quality bond 4-7 days flows, in the meantime, have turned constructive for the very first time given that November 2022, the bank’s info confirmed. Inflows to emerging market equities have attained $37.4 billion 12 months to day, all-around $152.3 billion annualized, which would be the biggest total at any time if inflows continue in this rate.

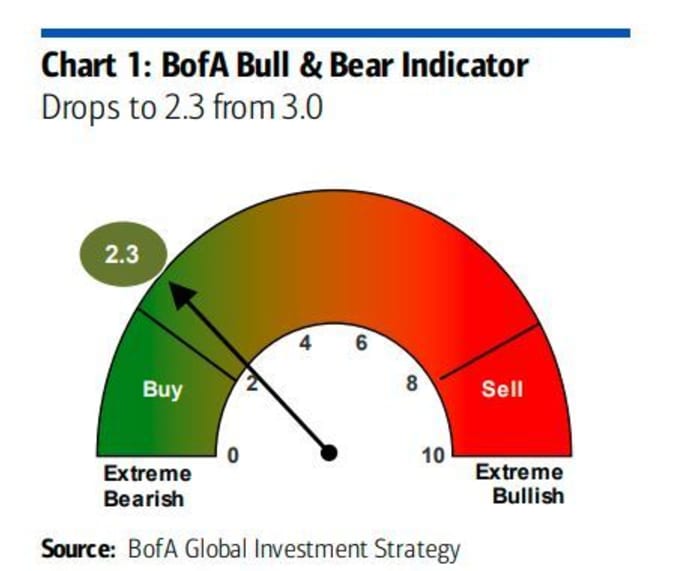

Hartnett and the group, also hinted nevertheless that some dip-purchasing alternatives could be all around the corner. Their Bull & Bear Indicator dropped to 2.3 from 3. in the latest 7 days, pushing further into “contrarian buy” territory.

Uncredited

A get signal for riskier property is triggered when the Bull & Bear Indicator drops under 2.. And regular 3-month moves right after 9 “buy” indicators considering the fact that 2013 have seen bond yields rise 43% and global stocks up 7.6%, the bank explained.

Read: Michael Burry of ‘Big Short’ fame states he was ‘wrong’ to inform traders to ‘sell’

[ad_2]

Supply url