[ad_1]

Shares of Carnival Corp. took a dive Friday, as the cruise operator’s first quarterly financial gain considering that in advance of the COVID pandemic, amid history revenue and bookings, was overshadowed by a disappointing outlook.

“While we see no symptoms of demand slowing for our makes, at some level, scheduling volumes for 2024 will recede as we simply just operate out of stock,” explained Chief Govt Josh Weinstein on a publish-earnings conference get in touch with with analysts, according to an AlphaSense transcript.

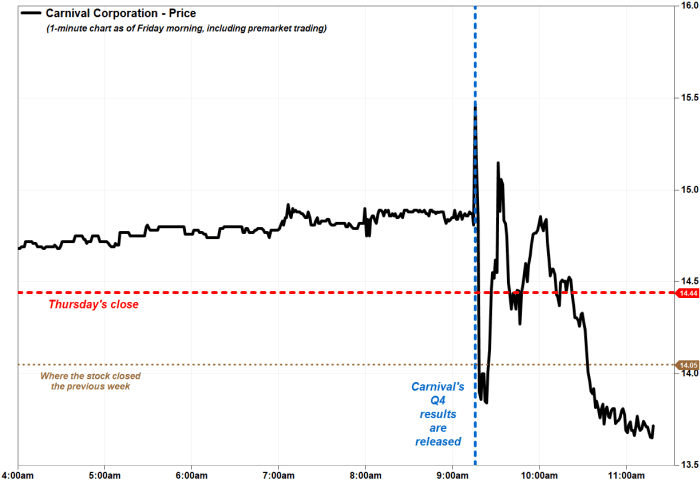

The stock

CCL,

CCL,

had swung between gains and losses before in the session, prior to it dedicated to a sharp loss all-around mid-early morning.

Carnival’s stock falls in choppy buying and selling following earnings report.

FactSet, MarketWatch

The inventory slumped 7.7% in afternoon investing toward the cheapest close given that June 9, and to set it on observe to experience a fifth-straight weekly loss. It was also headed for the greatest a person-day selloff due to the fact it tumbled 13.7% on Nov. 16, 2022.

The company swung to fiscal third-quarter net income for the quarter to Aug. 31 of $1.07 billion, or 79 cents a share, from a decline of $770 million, or 65 cents a share, in the exact period of time a yr in the past.

Excluding nonrecurring items, altered earnings for each share for the quarter to Aug. 31 of 86 cents, which as opposed with a per-share decline of 58 cents final 12 months, conquer the FactSet consensus of 75 cents.

The business had not documented a internet income because the quarter that finished in November 2019, in accordance to FactSet information, though the modified income was the initial because the quarter that finished February 2020. (COVID was declared a pandemic on March 11, 2020.)

Income grew 59.2% to $6.85 billion, earlier mentioned the FactSet consensus of $6.71 billion, as passenger ticket profits rose 75.2% to $4.55 billion and onboard and other earnings elevated 34.9% to $2.31 billion.

“Now, we respect there are heightened issues all-around the point out of the consumer as of late. But the actuality is, we just haven’t witnessed it in our bookings or final results,” Weinstein mentioned. “And we feel individuals are continuing to prioritize spending on ordeals about substance products.”

Scheduling volumes continued at “significantly elevated amounts,” Carnival mentioned, as the company set a new third-quarter file for full bookings that were being functioning just about 20% previously mentioned 2019 ranges.

For the fourth quarter, even so, the firm stated it expects an adjusted for every-share loss of 18 cents to 10 cents, broader than the present-day FactSet loss consensus of 8 cents a share.

And the corporation expects earnings prior to desire, taxes, depreciation and amortization (Ebitda) — what companies use as a measure of fundamental profitability — of $800 million to $900 million, down below the FactSet consensus of $950 million.

For the company’s fiscal 2023 outlook, the guidance selection for adjusted Ebitda was revised reduce to $4.10 billion to $4.20 billion from $4.10 billion to $4.25 billion.

And the outlook for expansion in adjusted cruise expenditures excluding gasoline, in comparison with 2019 amounts, was raised to about 9.5% from prior direction of 8% to 9%.

The inventory has sunk 16.2% over its latest 5-week getting rid of streak, which would be the longest this sort of stretch considering that the 5-week streak that finished May 20, 2022.

It has plunged 22.3% in excess of the previous three months but has soared 65.4% yr to day. In comparison, the S&P 500 index

SPX

has misplaced 2.6% in the past three months, but has received 11.6% this year.

[ad_2]

Source link