[ad_1]

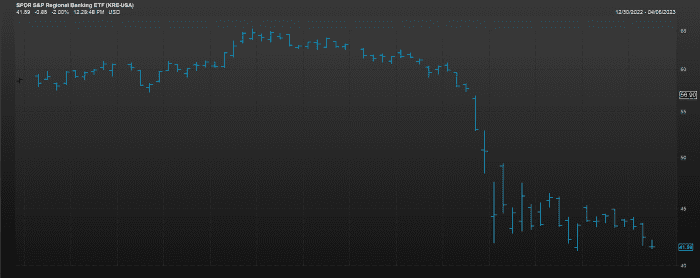

A trio of bank collapses previous month turned a regional-financial institution monitoring trade-traded fund into something of a market bellwether. And right after a small stretch of price tag stability it’s “hanging by a thread,” a Wall Street technician warned on Wednesday.

The SPDR S&P Regional Banking ETF

KRE,

was down 2% in the vicinity of $41.65 shortly soon after midday, putting it on observe for its least expensive shut considering that November 2020, in accordance to FactSet details, buying and selling underneath its March 23 near at $42.24 although keeping earlier mentioned its March 24 intraday low at $41.28. KRE fell sharply on Tuesday as the S&P 500 index

SPX,

and Dow Jones Industrial Normal

DJIA,

observed modest declines, snapping 4-working day winning streaks.

“Yesterday was a poorer session than the significant cap indices implied, with the regional financial institutions once once again top the current market lower. KRE, the regional banking ETF, appears to be to me like it’s hanging on by a thread as it tries to make a ‘triple bottom’ and hold earlier mentioned its latest lows,” wrote technical analyst Andrew Adams in a Wednesday note for Saut System.

KRE attempting to put in a triple-bottom all-around $41.

FactSet

“I do not belief triple bottoms, as more usually than not that 3rd endeavor reduce finishes up breaking down to new lows and ruining the opportunity sample,” he claimed. “It appears to be like we’re very likely to get a decreased reduced in KRE and that has dragged the modest-caps down with it.”

Read through: Lender shares end tough quarter with gains as sector stabilizes even with outflows from savings accounts

The little-cap Russell 2000

RUT,

which has been weighed down by worries over regional financial institutions, was down 1.3% on Wednesday. The S&P 500 was off 04%, though the Dow was hanging on to a obtain of about 75 factors, or .2%.

Adams stated that the value motion all over KRE coming at a time when shorter-expression breadth, a measure of shares attaining floor vs . these that are slipping, was currently in the vicinity of an excessive and the Nasdaq-100

NDX,

was trading additional than two common deviations previously mentioned its 50-working day moving ordinary seemed to alert that a pullback “could be coming.”

The Nasdaq-100 has led stock current market gains in 2023, and stays up virtually 18% 12 months to day.

“The attributes and severity of that pullback should really then make clear irrespective of whether we’re most likely to then push increased at the time yet again or continue on to drop in the in close proximity to term,” he wrote.

[ad_2]

Supply website link