[ad_1]

Oil selling prices set a different 2023 superior this 7 days as fears about a tightening market place pushed the Brent benchmark crude close to $100 a barrel, complicating the Federal Reserve’s work to convey down inflation forward of the September coverage assembly and raising fears that a U.S. economic downturn might be nonetheless on the horizon.

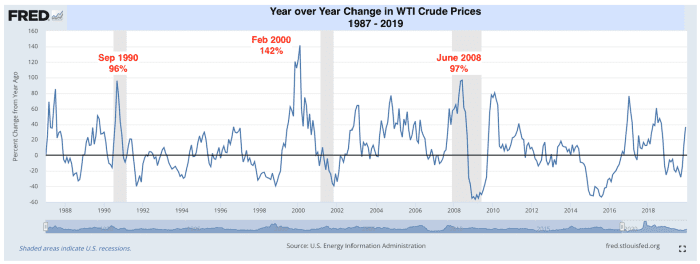

History exhibits that surging energy charges normally perform a role in tipping the U.S. into economic downturn. When oil rates doubled in September 1990, February 2000, and June 2008, the economic climate was either in a economic downturn or would soon be in just one, stated Nicholas Colas, co-founder of DataTrek Investigate, in a Tuesday notice (see chart beneath).

Resource: U.S. Energy Info ADMINISTRATION

“Oil price tag spikes subject much extra than modestly soaring prices. House earnings is rather mounted in the close to expression, so spiking oil or gasoline charges pressure them to rapidly cut back again on other paying out types,” Colas mentioned. “The higher the boost, the much more possible a economic downturn sooner or later unfolds.”

But this time, Colas is not specified if the similar dynamic will continue to enjoy out. For case in point, the U.S. benchmark West Texas Intermediate crude

CL00,

CL.1,

trended about $70 for each barrel in May and June, so it would consequently take a move to $140 per barrel to bring about a opportunity economic downturn. Nevertheless, the most the latest high for WTI was $123 per barrel in March 2022 following Russia’s invasion of Ukraine, so traders “have to see bigger oil prices than final year’s geopolitical conflict to get a economic downturn-inducing double more than the following 12 months,” Colas stated.

On Tuesday, the West Texas Intermediate crude for Oct supply

CLV23,

fell 28 cents, or .3%, to settle at $91.20 for every barrel on the New York Mercantile Exchange right after ending at $91.48 in the preceding session, the greatest entrance-month contract end considering that Nov. 7, in accordance to Dow Jones Sector Facts. November Brent crude

BRN00,

BRNX23,

the world wide benchmark, edged down .1%, to settle at $94.34 a barrel on Tuesday immediately after a high of $95.96 on ICE Futures Europe.

“History states we are nowhere around obtaining to fear about climbing oil costs tipping the U.S. overall economy into a economic downturn,” Colas claimed. “Now, if WTI promptly rises to about $100 for each barrel and would seem established to go swiftly increased, then cash marketplaces may possibly commence to pay notice.”

A single of Wall Street’s most bearish oil analysts, Edward Morse, worldwide head of commodity research at Citigroup, said that Brent could surpass $100 a barrel “for a brief while” amid mounting concerns in excess of a supply lack adhering to new output cuts by Saudi Arabia and Russia, which have been prolonged right until the stop of this calendar year, as nicely as geopolitical tensions. Nonetheless, he mentioned the uptick in oil costs will likely retreat subsequent calendar year.

“The Saudi hunger to withhold oil from sector, supported by Russia maintaining a sure stage of export constraint, details to greater prices in the short phrase, all else equivalent, but $90 prices appear unsustainable provided speedier source progress than demand from customers growth ex-Saudi/Russia,” Morse reported in a Monday be aware. “Higher selling prices in the in the vicinity of expression could make for extra draw back for rates following calendar year.”

See: Individuals get notice as inflation bites and oil charges best $90 a barrel

The fall in oil price ranges played a important position in cooling U.S. inflation in the first fifty percent of 2023, but traders worry the the latest surge in oil charges will act as a brake as the Federal Reserve is nearing the stop of its interest-amount mountaineering campaign.

Neil Shearing, team main economist at Cash Economics, mentioned the strategy that bigger oil prices are an inflationary danger in sophisticated economies is “easy to overstate.”

If Brent crude selling prices remain at their latest amount of about $95 per barrel through the finish of the yr, energy will really be “a drag” on headline inflation in produced markets, Shearing said. “Things get much more sophisticated by early 2024, when oil is very likely to make a constructive contribution to headline inflation. But this is likely to be overwhelmed by other disinflationary forces.”

See: 4 issues to observe for at this week’s Fed financial-policy meeting

U.S. stocks completed reduce on Tuesday as buyers awaited the Federal Reserve’s interest-fee determination on Wednesday afternoon. The S&P 500

SPX

finished .2% reduce, while the Dow Jones Industrial Average

DJIA

was off .3% and the Nasdaq Composite

COMP

dropped .2%.

[ad_2]

Source url