[ad_1]

A mixture of hawkish remarks by a pair of Federal Reserve officials, strong bank earnings experiences, and a rebounding shopper-sentiment reading through on Friday are among the elements contributing to another abrupt readjustment in the economical market’s contemplating about the route of interest charges.

The sudden readjustment dented the common look at that the Federal Reserve may be approaching the finish of its yearlong rate-hike cycle. All a few important U.S. inventory indexes

DJIA,

COMP,

completed lower, even though Treasury yields jumped — led by a 39.5-basis-point rise in the 1-thirty day period T-bill level

TMUBMUSD01M,

according to Tradeweb. The ICE U.S. Greenback Index

DXY,

jumped .5%. And fed cash futures traders boosted the prospects of Fed fee hikes in Might and June, while paring their anticipations for amount cuts later on this calendar year.

“Everything the market place considered as of the shut yesterday was contradicted right now,” claimed Steve Englander, the New York-based head of international G10 Forex research and North The usa macro strategy for Typical Chartered Financial institution. As he place it, “everything went mistaken in the ‘Fed-is-likely-to-prevent-soon’ trade,” even though any potential spillover from the banking-associated anxiety has the opportunity to curtail policy makers’ rate-hike cycle.

Friday’s details involved a report from the College of Michigan, which showed customer sentiment creeping up and Individuals far more anxious about significant inflation. And even though retail sales tumbled by far more than anticipated in March, some persons noticed the possible for even deeper weak point, which didn’t come to fruition, Englander reported. On prime of this, JPMorgan Chase

JPM,

and Citigroup Inc.

C,

reported initial-quarter benefits that delighted traders.

In the meantime, two Fed policy makers stepped into the fold with hawkish reviews. Fed Gov. Christopher Waller said he sees the have to have for the central lender to continue to keep elevating rates, whilst Atlanta Fed President Raphael Bostic told Reuters that the latest inflation knowledge “are reliable with us shifting a person additional time.”

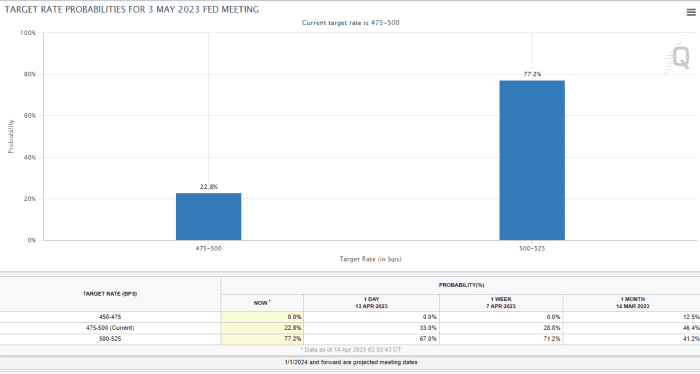

As a end result, fed money futures traders set a far more than 70% chance on a further quarter-of-a-percentage-stage amount hike in May well, which would carry the Fed’s primary curiosity-price target to amongst 5% and 5.25%, and they boosted the chance of a identical-size move in June, according to the CME FedWatch Tool.

Source: CME FedWatch Instrument, as of Friday.

“The million-greenback question is, ‘how substantially extra does the Fed have to do?’” said Rob Daly, director of preset earnings at Glenmede Financial investment Administration in Philadelphia. “I’m in the camp that believes it may well be one particular or two much more hikes, but the up coming problem is, ‘how prolonged do they maintain fees elevated?’”

“Risk property have remained incredibly resilient, we’ve noticed a pretty robust labor market, and inflation is continue to superior,” Daly explained through phone. “I do not see any explanation the Fed would be chopping charges at any time before long. The information has been resilient and not automatically weak ample for the Fed to alter training course.”

[ad_2]

Resource link