[ad_1]

The S&P 500 index exited a bear sector on Thursday, when a intently viewed gauge of inventory-sector volatility dropped to a additional-than-a few-calendar year lower. All those two points are relevant, says Fundstrat World wide Advisors founder Tom Lee.

The Cboe Volatility Index

VIX,

an selections-derived measure of expected volatility in the S&P 500 above the coming 30 days, traded as very low as 13.50 on Friday, its least expensive given that February 2020. The gauge’s lengthy-expression average is in close proximity to 19. A subdued examining implies buyers are feeling optimistic. The VIX averaged 25 in 2022, even though the S&P 500 posted a drop of 19.4%.

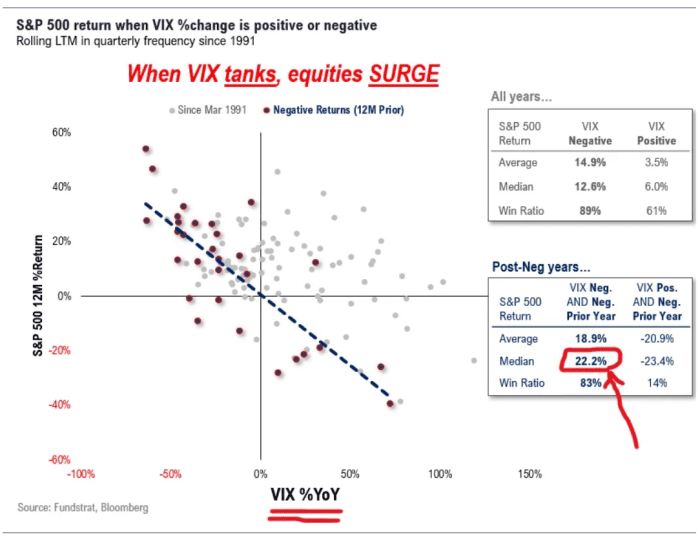

“The VIX affect is the least appreciated. Our operate from December 2022 displays that in previous 30 yrs, post-adverse equity calendar year (2022), when VIX is down [year-over-year], the median attain is 22%,” Lee stated in a Friday morning note to shoppers (see chart below).

Fundstrat

The VIX’s part is greater than the affect from moves in the U.S. dollar, earnings for each share or even bond yields, Lee reported.

“VIX trajectory, in other text, was the solitary largest determinant at the start out of 2023. This appears to be participating in out nowadays,” he wrote.

The S&P 500

SPX,

rose 4.93 details, or .1%, Friday afternoon to shut at 4,298.86. On Thursday it closed at 4,293.93, its best close given that Aug. 16. Moreover, it concluded additional than 20% previously mentioned its Oct. 12, 2022, closing very low, conference greatly utilized standards that marks the conclude of a bear market.

The Dow Jones Industrial Average DJIA finished with a achieve of 43.17 factors, or .1%, although the Nasdaq Composite

COMP,

gained .2%.

For the S&P 500, there are plenty of skeptics who see a headfake relatively than a newborn bull sector. The concentrated character of the S&P 500’s rally, which has been fueled to an severe degree by gains for a handful of megacap, tech-associated shares, makes lots of traders wary mainly because the regular inventory has been still left behind.

Though the S&P 500, which is weighted by market place capitalization, is up a lot more than 12% so significantly in 2023, the equal-weighted evaluate of the S&P 500 has received just 2.6%.

Browse: How a hawkish Fed could eliminate a little one bull-industry rally in U.S. stocks

Many others concern an uncertain economic outlook, arguing that a extra pessimistic consider reflected in the bond sector could immediately unravel the inventory sector rally if it proves accurate.

Need to have to Know: Shares would slide correct back into a bear marketplace if they adopted financial look at of bond current market, JPMorgan suggests

So now what? Lee claimed with the VIX beneath 14, it very likely will not be a driver of long term gains.

Now, the current market faces what might be its “most consequential” 7 days of the 12 months, with the May buyer-cost index set for launch on Tuesday and the Federal Reserve concluding a two-working day plan conference on Wednesday.

Fed-money futures traders have priced in a about 72% probability the central financial institution will go away charges unchanged next week, in accordance to the CME FedWatch tool, pausing following a sequence of price increases that took the benchmark fee from near zero to the existing assortment of 5% to 5.25% due to the fact March of very last year. But they be expecting the Fed to produce a hike in July.

See: Fed may hike fascination fees once more in June rather of a ‘skip,’ some economists consider

When the VIX at its present level isn’t automatically a acquire sign on its have, “we continue to see upside drivers for the S&P 500 about the upcoming 6 months. The key driver being that inflationary pressures relieve quicker than consensus expects and at a speed that will enable the Fed to sluggish its rate of hikes,” Lee claimed.

With the caveat that up coming week’s situations are essential, Fundstrat’s foundation circumstance stays that the S&P 500 will obtain extra than 20% in 2023, with the 4,300 amount serving as a “waypoint” that will finally give way to equity marketplaces building new highs this 12 months, he stated.

[ad_2]

Source url