[ad_1]

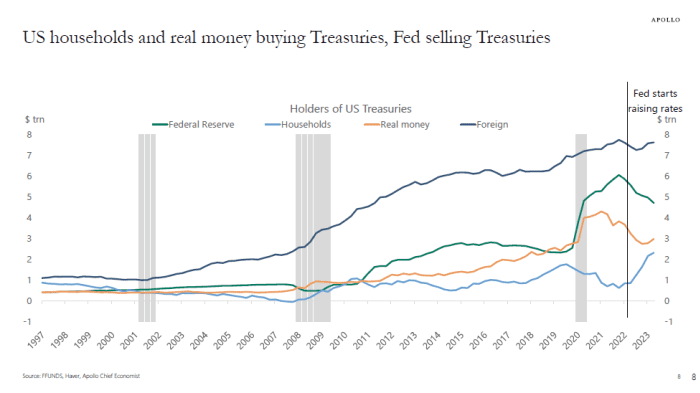

U.S. homes have created major moves in the around $25 trillion U.S. Treasury market due to the fact the Federal Reserve commenced its marketing campaign of rate hikes past yr.

Their holdings have shot up to about $2.5 trillion from much less than $1 trillion when the Fed commenced elevating premiums in 2022, to attain the greatest level in the past 25 decades, in accordance to Torsten Slok, chief economist at Apollo World wide Administration.

U.S. households now own more Treasury securities than any time in the earlier 25 years.

FFUNDS, Haver, Apollo Main Economist

“The base line is that US homes and authentic money are acquiring existing degrees of US yields desirable,” Slok wrote in emailed commentary Friday.

The sharp rise of the 10-12 months Treasury produce

BX:TMUBMUSD10Y

to almost 4.5% in recent sessions, the best level due to the fact late 2007, has been a vital focus on Wall Road. Significant technology stocks and other level-sensitive sectors of the current market marketed off sharply just after the Federal Reserve signaled it could keep its plan rate higher for extended than expected.

A slight pullback Friday in the 10-year Treasury produce, a benchmark rate employed to gas the U.S. economic system, was supplying shares a slight enhance, but equities continue to were on speed for sharp weekly losses.

See: ‘Hurricane’ in Treasurys relents marginally as yields dip from multi-yr highs

For the week, the S&P 500 index’s

SPX

buyer discretionary section was major the inventory-current market gauge reduced, down 5% at last examine Friday. That may be a indication that buyers imagine organizations concentrated on luxurious products, like motor vehicles, furnishings, vacations and other nonessential merchandise, could be susceptible to a fizzling economic system.

Tesla Inc.

TSLA,

shares have been far more than 7% decreased on the 7 days, at previous check out, though people of Amazon.com Inc.

AMZN,

ended up off about 6.7%, although some others in the “Magnificent Seven” pack of outperforming shares this 12 months were being also on tempo for losses because Monday.

Increased borrowing expenditures bite shoppers, but also threaten main corporations dealing with a pile of maturing personal debt in the future number of several years. More mature, reduce coupon securities in a portfolio also now glance significantly less beneficial.

Gains for the calendar year in a swath of the bond industry have been erased by mounting yields, with the benchmark Bloomberg U.S. Combination index on tempo for a – .6% return on the calendar year by Friday, and -14.4% on a a few-calendar year return, in accordance to FactSet.

The iShares Core U.S. Combination Bond ETF,

AGG

an exchange-traded fund that tracks the Bloomberg index, was down 2.1% on the yr through Friday.

[ad_2]

Supply website link