[ad_1]

Goldman Sachs this week increased its default forecast for U.S. higher-produce, or “junk-rated,” corporate bonds this year to 4% from 2.8% immediately after far more providers this year have been buckling beneath their debts.

The cloudier outlook for junk bonds arrives as Wall Street feels the squeeze of tighter credit rating conditions, whilst bracing for the economic backdrop to get worse.

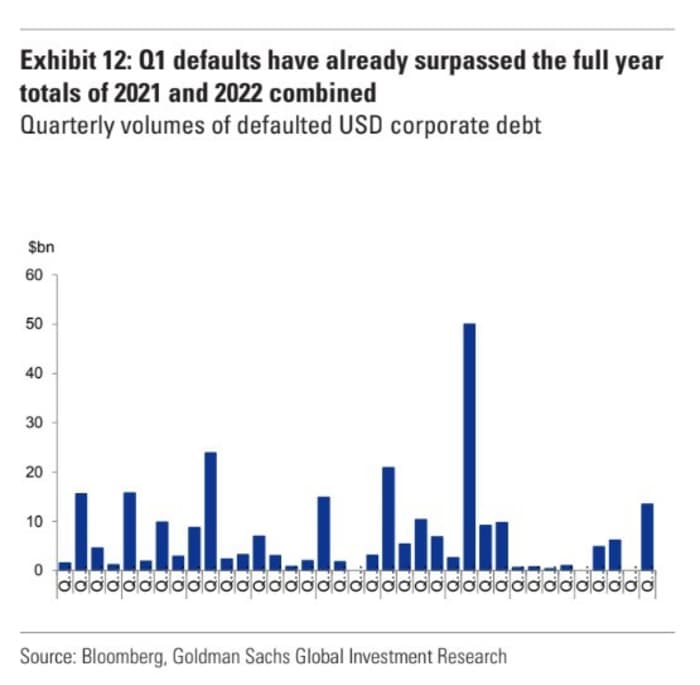

With additional than $11 billion of junk bonds subject matter to company defaults in the initial quarter (see chart), the volume now has surpassed the total dollar total for all of 2021 and 2022.

U.S. junk-bond defaults in Q1 leading final two yrs merged.

Bloomberg, Goldman Sachs

Corporate defaults were exceptional right before the Federal Reserve started out elevating fascination rates very last calendar year. Above the lengthier time period, the junk-bond sector’s ordinary annually default charge was 4.3% for the earlier 25 decades, in accordance to Goldman knowledge.

Lotfi Karoui’s credit history research team at Goldman reported, “many investors are inquiring what the ahead pipeline of defaults seems to be like from right here,” in a weekly customer note. Worries have been elevated as corporate defaults jumped to get started 2023, with far more predicted as credit conditions tighten just after the failures of Signature Bank

SBNY,

and Silicon Valley Bank.

Distress hits $120 billion

Distressed bond supply in the U.S. junk-bond current market hit about $120 billion as of a week ago, in accordance to CreditSights. In the times prior to the two banking institutions defaulted, there had been pretty much 100 issuers with financial debt trading in distressed territory, or at a distribute of at minimum 1,000 basis points higher than Treasury generate, according to CreditSights.

“It’s the speed and magnitude of curiosity-fee hikes that made areas of the tech sector unviable, and led to the collapse of Silicon Valley Lender,” mentioned Evan DuFaux, a particular scenarios analyst at CreditSights, by mobile phone Friday.

“Those results will be felt in the course of the economic system, and notably in the case of leveraged companies.”

Separately, Goldman’s economics group on Friday explained worry in the banking sector will tighten credit score ailments, gauging the expected pullback from regional U.S. banking institutions by yourself as equivalent to Fed fascination fee hikes of 25-50 basis details.

That was a theme Federal Reserve Chairman Jerome Powell drilled down on Wednesday in a news conference subsequent yet another Fed level hike of 25 foundation points on Wednesday. “The concern is, how significant will this credit tightening be and how sustainable it will be. Which is the issue,” Powell claimed on Wednesday.

Like U.S. home owners, numerous providers snapped up low cost personal debt during the pandemic to refinance at traditionally small costs just after the Fed minimize prices in March 2020 to nearly zero and held them there for about two decades. Borrowing in equally sectors has slowed dramatically in modern months.

The Fed has by now raised its policy rated to a selection of 4.75 to 5% in a year, with a terminal charge array penciled in at 5% to 5.25%.

That has hurt banks’ holdings of Treasurys and mortgage bond securities, placing an estimated $620 billion of their securities underwater on a mark-to-industry foundation.

U.S. stocks were volatile in the earlier week, but posted weekly gains. The Dow Jones Industrial Regular

DJIA,

highly developed .4% Friday, the S&P 500 Index

SPX,

rose .6% and the Nasdaq Composite Index

COMP,

climbed .3%, according to FactSet.

[ad_2]

Resource backlink