[ad_1]

U.K. bond yields jumped Wednesday right after info demonstrating inflation lingering higher than 10%.

The generate on the 2-yr gilt

TMBMKGB-02Y,

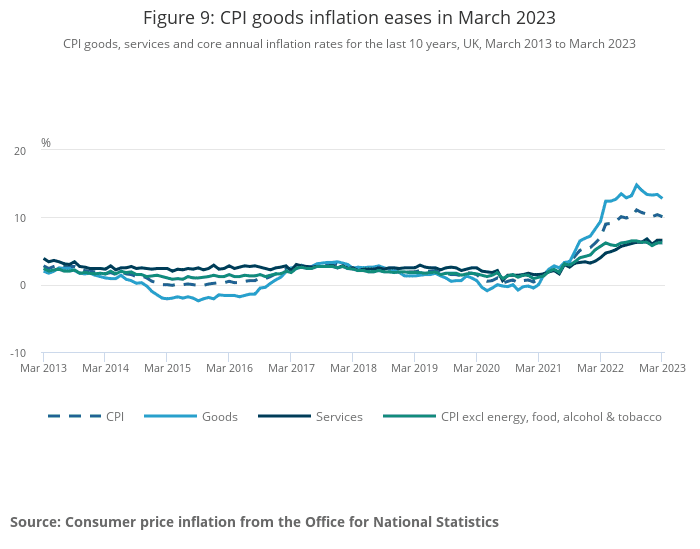

rose 13 basis points to 3.81% as the Place of work for Countrywide Studies claimed that inflation in March slowed to 10.1% yr-around-12 months from 10.4%, and that main inflation stayed at 6.2%. Economists polled by Reuters predicted inflation to simplicity to 9.8%.

The pound

GBPUSD,

moved up to $1.2466 from $1.2424.

As opposed to in the U.S., main merchandise inflation has remained stubbornly substantial, owing to costs on clothing and household furniture, irrespective of a drop in long lasting-products charges.

ONS

“It’s not rather a slam dunk for a May possibly level hike – although markets are entirely pricing that outcome now. We agree that it is now probably a lot more likely than not in light of this week’s inflation and wage information, having up until eventually now forecasted no change,” said James Smith, formulated industry economist at ING.

In reality, marketplaces are now extra than fully pricing in a price hike, with expectations now of a 27 foundation position enhance, as marketplaces also assign an 82% opportunity of a June price rise.

Chancellor of the Exchequer Jeremy Hunt reiterated the government’s view that inflation will be halved this year, citing forecasts from the Office environment for Finances Obligation.

[ad_2]

Supply hyperlink