[ad_1]

Federal Reserve Chairman Jerome Powell has continuously said undercutting wage development for American staff is important for tamping down the worst bout of inflation in the U.S. in more than 40 yrs.

But a raft of facts recommend that sturdy company revenue margins — not wages — are acquiring a a great deal more substantial impact on soaring price ranges, in accordance to longtime Société Générale strategist Albert Edwards.

Edwards phone calls this dynamic “greedflation”: the notion that corporate selling price gouging is assisting to keep inflation strong at a time when commodity charges, which have been originally blamed for the cost shock, have essentially fallen about the previous 12 months.

West Texas Intermediate crude oil

CL00,

was trading at approximately $77 a barrel on Thursday, in comparison with $115 a barrel a single 12 months ago, in accordance to FactSet information. Price ranges of other essential industrial commodities, together with copper, have also declined through the exact same time period.

In his latest notice on the subject matter, shared with MarketWatch Thursday, Edwards questioned why the Fed has been so insistent on targeting wages alternatively of pointing the finger at corporations: “the most important driver of this inflation cycle is soaring income margins. Somewhat than calling this out as the primary induce of superior inflation, central banking companies have rather decided on to emphasis on mounting nominal wages as threatening to embed larger inflation – the so referred to as ‘wage/price tag spiral’.”

Generally, corporations are elevating selling prices of goods and providers not mainly because they need to owing to rising labor and uncooked materials expenditures, but due to the fact they can get away with it by blaming inflation, something that buyers have been primed by media reviews to expect, Edwards said.

Blaming wage development for inflation appears specially misguided looking at that workers’ wages haven’t even kept rate with growing client price ranges, Edwards said.

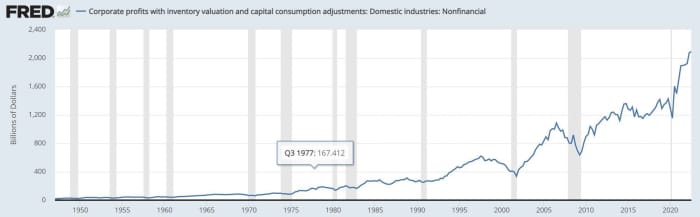

In the meantime, corporate financial gain margins have climbed to around-report highs. Earnings for non-money firms rose to approximately $2.1 trillion in the 3rd quarter, a document superior on a nominal foundation, according to Commerce Office info. They have risen sharply since the onset of the COVID-19 pandemic in March 2020.

ST. LOUIS FED

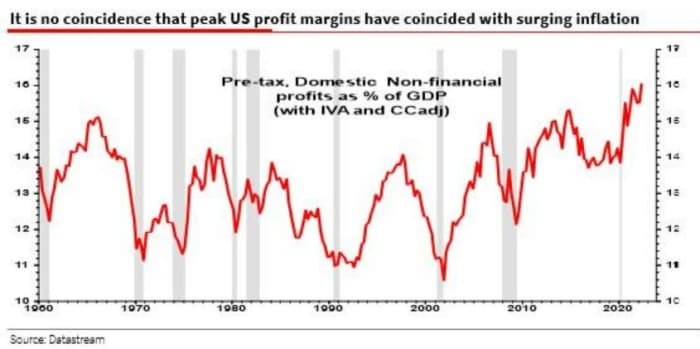

This isn’t the initially time Edwards has explored this topic in his study shared with Societe Generale customers. He examined the problem of selling price gouging in a notice revealed back again in November. The chart underneath, which reveals how corporate revenue as a share of GDP have risen to history highs, is from that earlier be aware.

SOCGEN

Whilst workers’ earnings have commonly increased, they haven’t kept pace with climbing consumer price ranges, which usually means that, when adjusted for inflation, workers’ earning ability has basically declined.

Typical hourly earnings improved by 4.6% year-above-year, according to the most up-to-date month-to-month work details produced by the Division of Labor. That’s fewer than the headline 12 months-more than-yr increase in the purchaser-rate index, which stood at 6%.

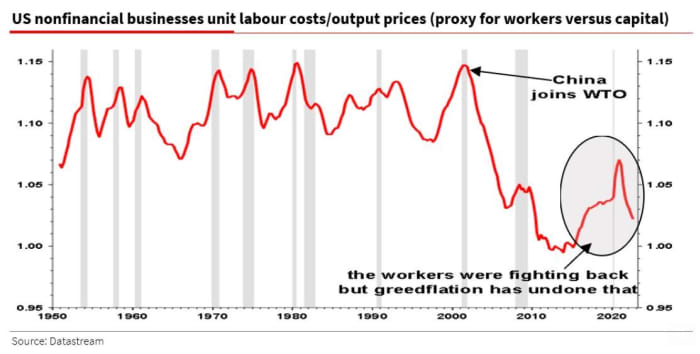

Also, Edwards confirmed that U.S. workers’ earnings in comparison to the expenses of the goods and providers they aid to generate had been declining for several years, tracing the begin of the development to when China joined the Planet Trade Firm in December 2001.

SOCGEN

Making use of an case in point taken from Howard College economics professor William Spriggs, Edwards pointed out that if wages genuinely are the driving inflation, then the price of meals at dining places should really be rising more rapidly than the value of foodstuff eaten at household for the reason that of the charge of labor.

But the opposite is genuine, according to the consumer-price tag index, a intently viewed gauge of inflation manufactured by the U.S. govt.

The value of meals eaten at household has risen by 10.2% in the course of the calendar year by February, according to the hottest CPI details from February. By comparison, the price of meals customer absent from household has greater by 8.4%.

“If wage inflation was pushing selling prices greater, foods at residence would exceed food items away from household,” Edwards said.

For that reason, “wages are not the issue.”

[ad_2]

Source hyperlink