[ad_1]

Friday could be a historic day for the U.S. alternatives market, according to a derivatives strategist at Goldman Sachs Group.

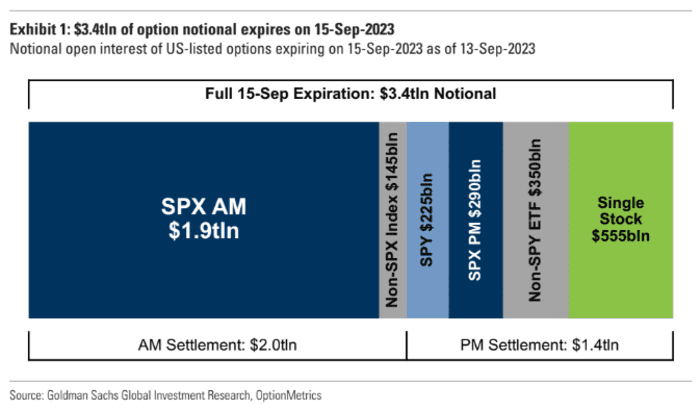

As trading in U.S. stock alternatives, primarily incredibly limited-dated zero working day to expiration selections, proceeds to growth, contracts connected to $3.4 trillion worth of U.S. stocks, exchange-traded money and fairness indexes like the S&P 500 are established to expire Friday in the course of September’s expiry for month to month and quarterly choices, according to the hottest figures from John Marshall, head of derivatives analysis at the investment decision lender that were being precise as of midweek.

That is on observe to be the largest September expiry on record, increasing the chance that marketplaces could finish the week on a unstable note.

In a breakdown of notional value because of to expire, Goldman showed that almost $2 trillion of S&P 500 index selections are owing to expire Friday early morning, whilst one-stock possibilities with a notional price of $555 billion will expire afterwards in the working day, together with a host of other contracts.

In alternatives-current market parlance, notional worth refers to the value of the fundamental securities or indexes controlled by the choice. Commonly, index possibilities are settled in income, whilst options on single stocks and ETFs are settled in shares.

GOLDMAN SACHS

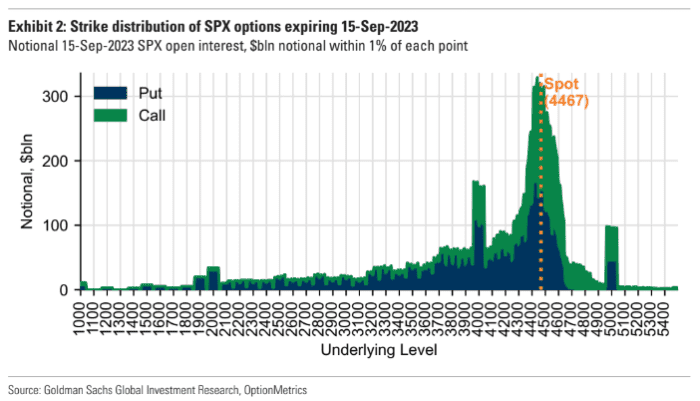

Given that U.S. stocks have seesawed in excess of the previous few of weeks, a massive share of choices expiring on Friday are quite close to being in the money, which could more exacerbate current market volatility, Marshall stated. It is deemed traditional knowledge on Wall Avenue that quarterly alternatives expiry days typically coincide with choppy markets.

“Given the rangebound character of the equity market place about the past various months, a

substantial proportion of the open up fascination is in options with strike costs that are in the vicinity of the

existing place degree,” he stated.

GOLDMAN SACHS

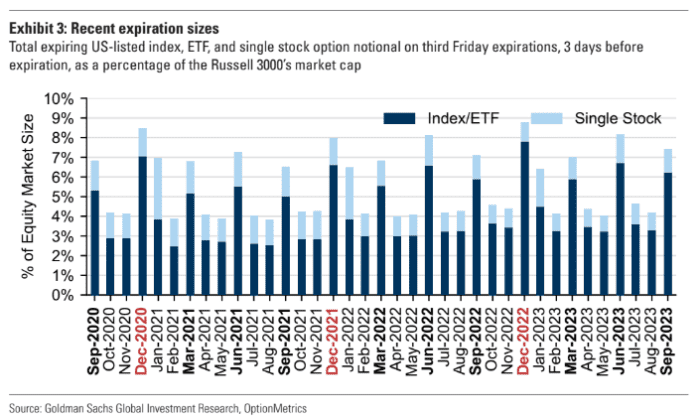

Friday’s expiration is established to be the sixth-biggest regular monthly expiration on record, in addition to being the most significant September.

GOLDMAN SACHS

This sort of large open desire is astonishing, Marshall explained, offered that stock-sector volatility stays somewhat subdued. In the meantime, investing quantity in quick-dated possibilities with significantly less than 24 several hours until finally expiration has increased, Marshall observed, and now includes 49% of activity in S&P 500 index selections.

Progress in trading of index and ETF-joined possibilities has served drive the surge in open desire ahead of September’s marquee party, Marshall extra.

An additional derivatives analyst, Nomura’s Charlie McElligott, warned shoppers to brace for prospective volatility, since 10 of the previous 11 September op-ex days noticed the S&P 500 finish lessen, with a median return of -.5%. Historic information also demonstrate that the week after September op-ex is normally rocky for stocks. September is, on ordinary, the worst thirty day period of the calendar year for the S&P 500’s performance.

McElligott also mentioned that an unusually big amount of money of publicity on selections dealers publications is set to evaporate on Friday, likely top to a lot more volatility as traders open new positions to substitute choices established to expire. Big quarterly possibility expiration gatherings generally correspond with around-time period marketplace weak point, according to Nomura’s assessment.

[ad_2]

Supply connection