[ad_1]

Lengthy-time period bonds glimpse interesting to Wells Fargo Expenditure Institute right after they ended up hurt by a surge in yields.

Losses on extensive-time period bonds a short while ago deepened as rising yields sent their price ranges reduced, with the rate on the 10-calendar year Treasury note leaping to a 16-year increased previously this month.

“Despite rising yields, we continue being favorable on period and buyers of extensive-term preset income,” mentioned Luis Alvarado, international set earnings strategist at Wells Fargo Financial investment institute, in a take note dated Oct. 9. “Yields at these degrees are most likely fantastic entry points to take into account for greenback-price averaging.”

The substantial increase in U.S. Treasury yields around the previous 3 months mostly was influenced by the Federal Reserve vowing to preserve desire prices higher for lengthier, with the hurdle to slash prices showing “quite significant,” according to the take note.

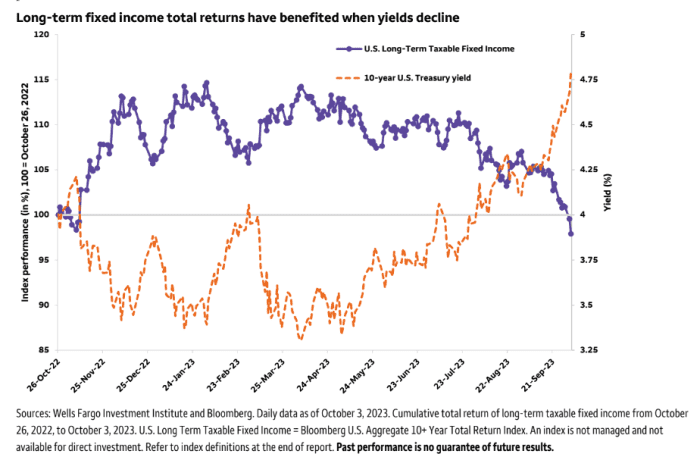

Nevertheless fixed-profits portfolios stand to benefit as some buyers foresee a potential economic economic downturn that might lead to price cuts by the Fed in 2024. A fall in yields would be excellent for effectiveness as that would travel up costs on lengthy-time period bonds, the chart below demonstrates.

WELLS FARGO Financial commitment INSTITUTE Take note DATED OCT. 9, 2023

“In the earlier five Fed hiking cycles, we have observed that extended-expression yields tended to peak just before the end of the tightening cycle,” claimed Alvarado.

The yield on the 10-12 months Treasury note

BX:TMUBMUSD10Y

was tumbling about 16 foundation factors on Tuesday to all around 4.65%, in accordance to FactSet facts, at previous examine. Two-12 months yields

BX:TMUBMUSD02Y

had been meanwhile down 11 foundation details at all-around 4.97%.

Whilst the generate curve has been inverted, with shorter-term premiums higher than extensive-expression types, yields on Treasurys with lengthier durations recently have risen in a so-identified as bear steepening.

“So significantly, we have skilled what we contact in bond jargon a ‘bear steepening’ of the yield curve,” reported Alvarado. That implies “yields on the lengthy conclude of the curve have been relocating larger (driving prices reduce),” he wrote “while yields on the small stop have remained flat, efficiently leading to a steepening of the curve.”

Read through: ‘It’s been a bloodbath’: Very long-time period bond ETFs deepen losses immediately after hotter-than-predicted jobs report

Wells Fargo doesn’t see substantially preserving extended-expression yields from continuing their push increased since of numerous elements like expectations for increased Treasury issuance, growing debt amounts, better debt fees, “some dysfunction in Washington” and customers that are so significantly resilient, in accordance to Alvarado.

Soaring yields have pummeled trade-traded cash that spend in extended-expression bonds, but as yields retreated on Tuesday, shares of the iShares 20+ Year Treasury Bond ETF

TLT

and iShares 10-20 12 months Treasury Bond ETF

TLH

ended up down marginally in afternoon trading soon after mounting sharply on Monday when the bond marketplace was shut for the reason that of Columbus Day.

Study: How 10-yr Treasurys could develop 20% returns, according to UBS

[ad_2]

Resource link